Who is Econet?

Established in 1993, Econet Wireless Zimbabwe is a telecom services provider giant and the first operator in Zimbabwe to launch data services with 3G technology. Econet, officially known as Econet Group, is a diversified telecommunications group with operations and investments in Africa, Europe, South America and the East Asia Pacific Rim, offering products and services in the core areas of mobile and fixed telephone services, broadband, satellite, optical fiber networks and mobile payment.

Subsidiaries of Econet include Econet Global, Econet Wireless Africa, Econet Enterprises, Liquid Telecom group and Econet Media…

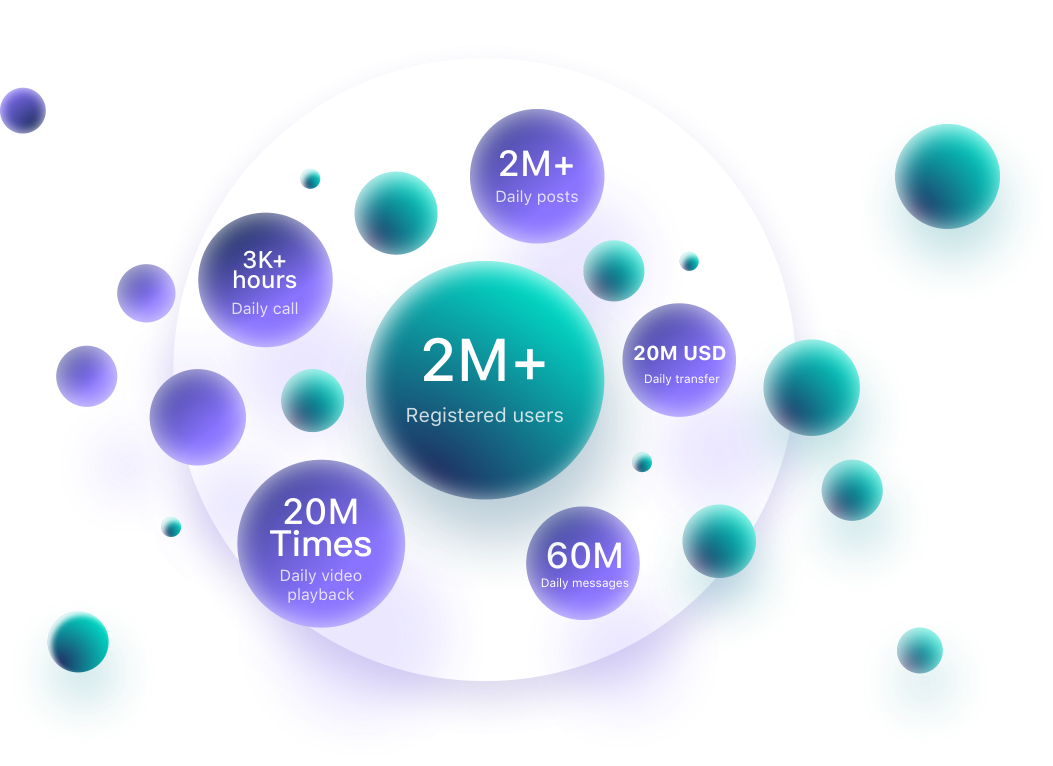

Over the past 20 years, Econet has been the market leader in its industry, with over 12.4 million subscribers.

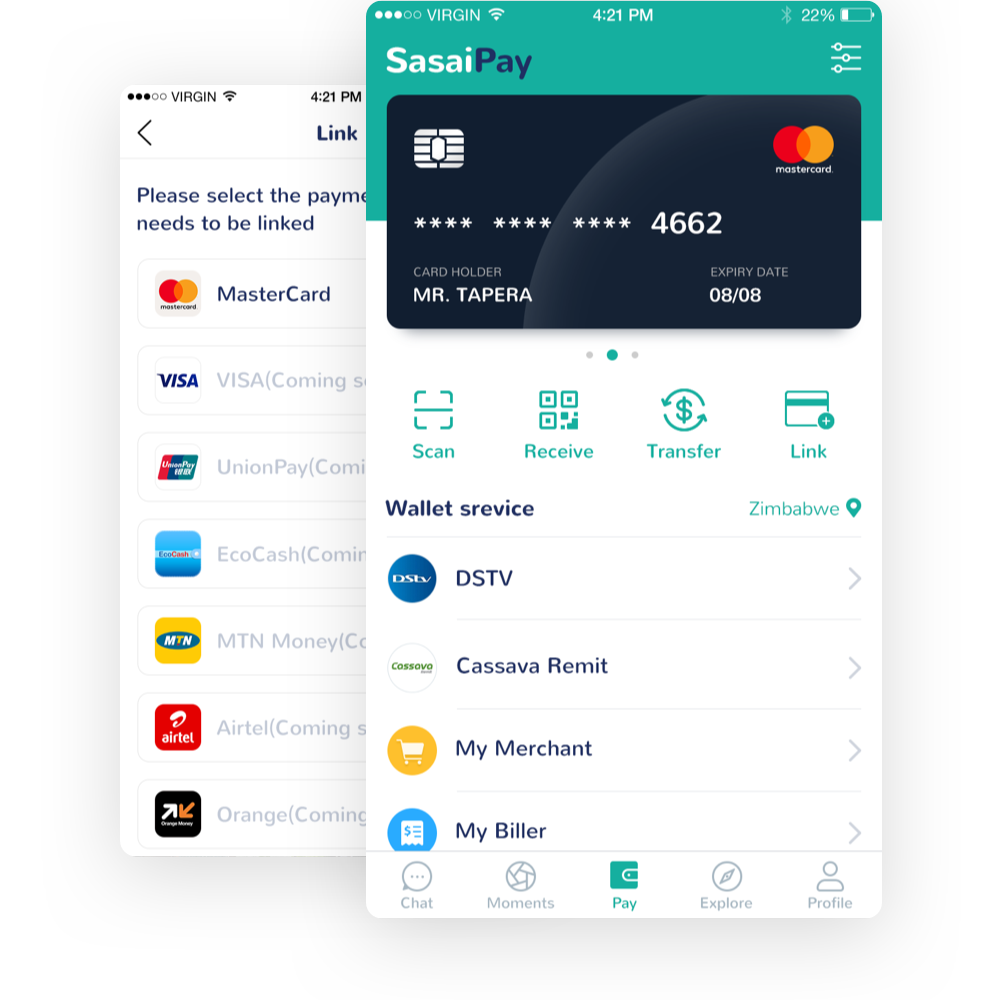

Ecocash, Econet’s mobile money service, now has 200 million USD transactions per day.